Buy to Flip

Regional Focus: Spotlight on the North East

In our recent blog post, The Changing Nature of the Buy to Let Market, I made reference to the interesting opportunity the North East presents. The 2008 financial crisis hit the North East particularly hard and unlike large parts of the rest of the country, it has not yet recovered from it. For example, as part…

Read MoreShould you Invest in Homes for Retired People?

The fact that the UK’s population is ageing has been well documented; in 2017 18% of the population were aged 65 and over. Understandably, when the property market is discussed, a lot of attention is directed towards the plight of first time buyers and their need for affordable housing. However, there is another important group that…

Read More6 Month Property Deal Update – ‘Off to a Flying Start!’

This is our first 6 month update; the first half of the year has proved to be both busy and challenging. We have successfully executed a number of projects that have contributed to our investors return on investment and despite the uncertainty in the economy, deals are still out there. 6 Month Property Deal Update…

Read MoreThe latest addition to our HMO Portfolio

It is important to have a diversified property portfolio which will create long term wealth through acquisition and deliver consistent cash income. In turn, this will provide day to day financial freedom by allowing you to become a landlord. In order to ensure you create the right balance, you need to consider a cross section…

Read MoreThird House Purchase – You make money when you buy, not when you sell

We have talked in previous blog posts of the need for a developer wherever possible to add value to property in their portfolio. This is normally achieved by extending upwards and outwards, adding rooms where possible and improving the layout and condition of the property. However, despite the amount of work involved or the cost…

Read MoreA maisonette in London for under £50,000, how did that happen?

This is the second in a new series of blog posts in which we change from discussing the strategic and theoretical aspects of property investing to real world case studies. We call this practical property investment. As much as is possible, we will share with you property deals that we are actually working on or…

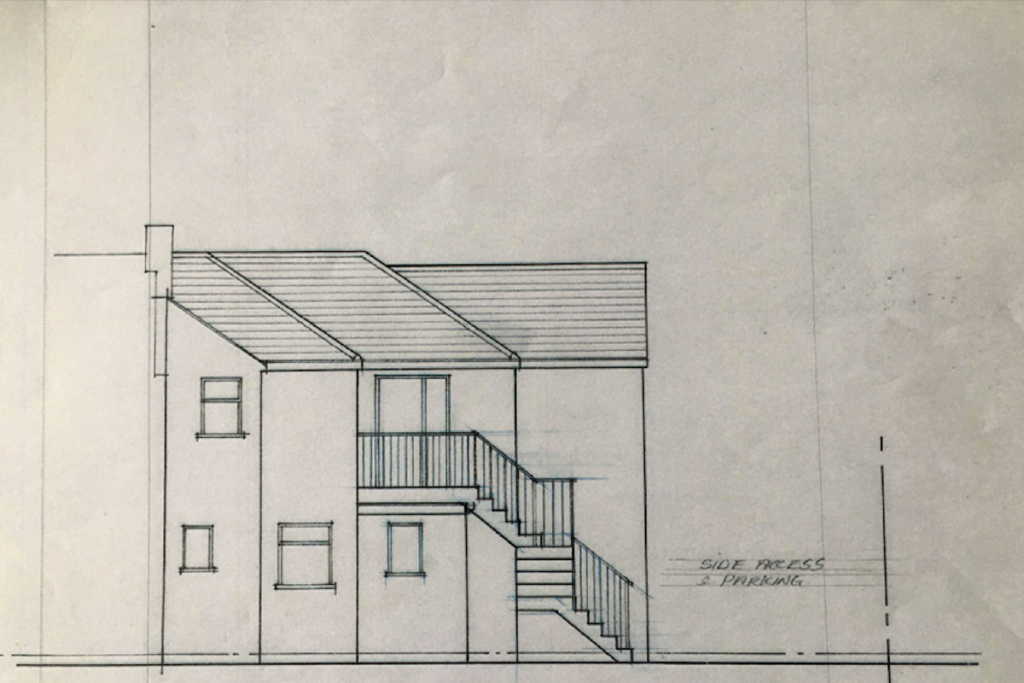

Read MorePractical Property Investment: House into Two Flats

This is the start of a new series of blog posts in which we change from discussing the strategic and theoretical aspects of property investing to real world case studies. We call this practical property investment. As much as is possible, we will share with you property deals that we are actually working on or…

Read MoreIs Buying at Auction Too Risky?

In the UK, TV programmes including Homes Under the Hammer have made buying property at auction seem very accessible to the general public. It is definitely a route that aspiring property investors should consider, but it is not without its pitfalls. For every investor that snags a bargain, there are probably four or five who make…

Read MoreHow to Add £2 of Value for Every £1 Invested in Home Improvements

Which home improvement adds the most value to your property? Everyone always ask the same question. In my opinion, the best person to answer this question is your estate agent. Unsurprisingly, the following are considered the top 3 home improvements that add maximum value. How to Add Value 1. Additional Bedroom Through Loft Conversion Half…

Read MoreNow is an Ideal time for Property Investors

According to the latest research from RICs , the national picture for the property market is one summarised by declining property sales and lower low levels of transactions overall. Compared to the Pre- Crash property market of 2008, we are at much lower levels of activity. As property investors, this is an ideal time because it…

Read More